How it works

Get Insured in 3 Simple and Effortless Steps

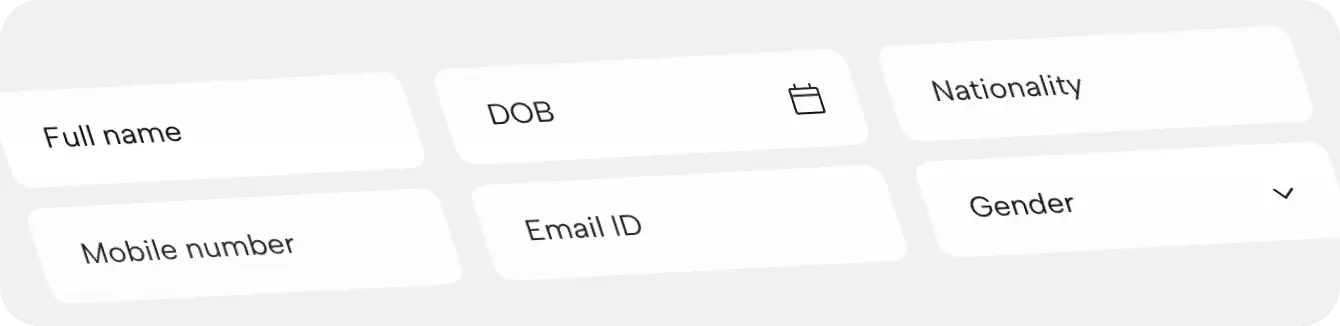

Enter Your Basic Details

Just fill in a few details about yourself and your insurance requirements. Filling in correct details will help in getting the best insurance quote.

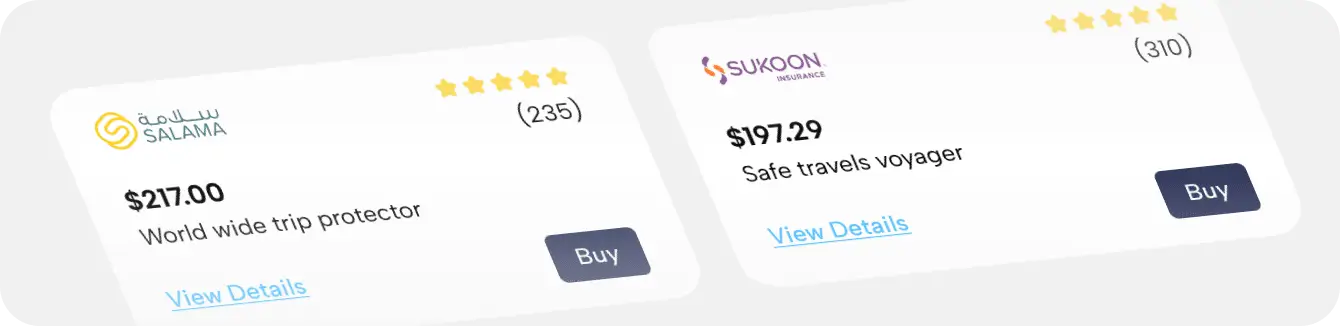

Compare Quotes

Instantly compare personalized quotes from UAE’s top insurance providers.

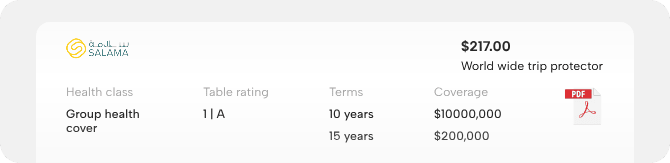

Pay And Get Your Policy

Choose the best deal for yourself and start saving on your coverage. Valid insurance is a must to avoid legal penalties and financial liabilities in UAE.

About Us

Welcome to ANIB – Your Trusted Insurance Provider

ANIB is your one stop solution for all types of insurance as per your requirements and preferences. As a leading insurance Brokers in UAE insurance market, we offer wide range of insurance solutions for individuals and businesses. Our team has years of experience in insurance industry and we are committed to provide best customer service.

Services

Take Better Insurance Opportunity

At Al Nabooda Insurance Brokers (ANIB), we protect individuals from unexpected injuries and financial losses. Our customizable insurance policies are designed to meet your needs and give you peace of mind in daily life.

- Car Insurance

- Health Insurance

- Home Insurance

- Travel Insurance

Car Insurance

Get your vehicle protected from accidents, theft, and damage with our comprehensive car insurance. Be covered on the road, no matter what happens. Our insurance experts will help you choose the best for yourself.

Team ANIB

Our Management Team

What Our Customers Say

Real Stories from Our Satisfied Customers

Choosing the right insurance can be daunting, but with us, it’s effortless and rewarding. Here’s why we are your perfect insurance partner:

Contact Form

Request a Free Consultation

Leave us with a bit of your information so we can get back to helping you find the right solution.

Get Every Updates

Read Our Latest News & Blog

May 22, 2017

ANIB XI on Top Win UAQ Municipality Cup Season 7!

ANIB XI on Top played the final match of the UAQ Municipality Cup on Friday 19th of May...

July 6, 2023

Property All–Risk Insurance: Protecting Your Assets and Ensuring Business Continuity

It's a kind of coverage that automatically applies to the building only, but not its contents...

July 26, 2023

The Power of Group Medical Insurance: Protecting Employees and Enhancing Business Success

Group medical insurance policies provide valuable protection and financial support to...